Edge

Sharpen your financial edge with Edge

Edge is an easy-to-use, interactive financial risk management module that delivers custom risk reports based on specific user preferences, financial variables, and economic scenarios. Hosted on the cloud, Edge guarantees data security, speed, and agility. Zero installation, zero maintenance, zero hassle. We maintain Edge – you reap the benefits.

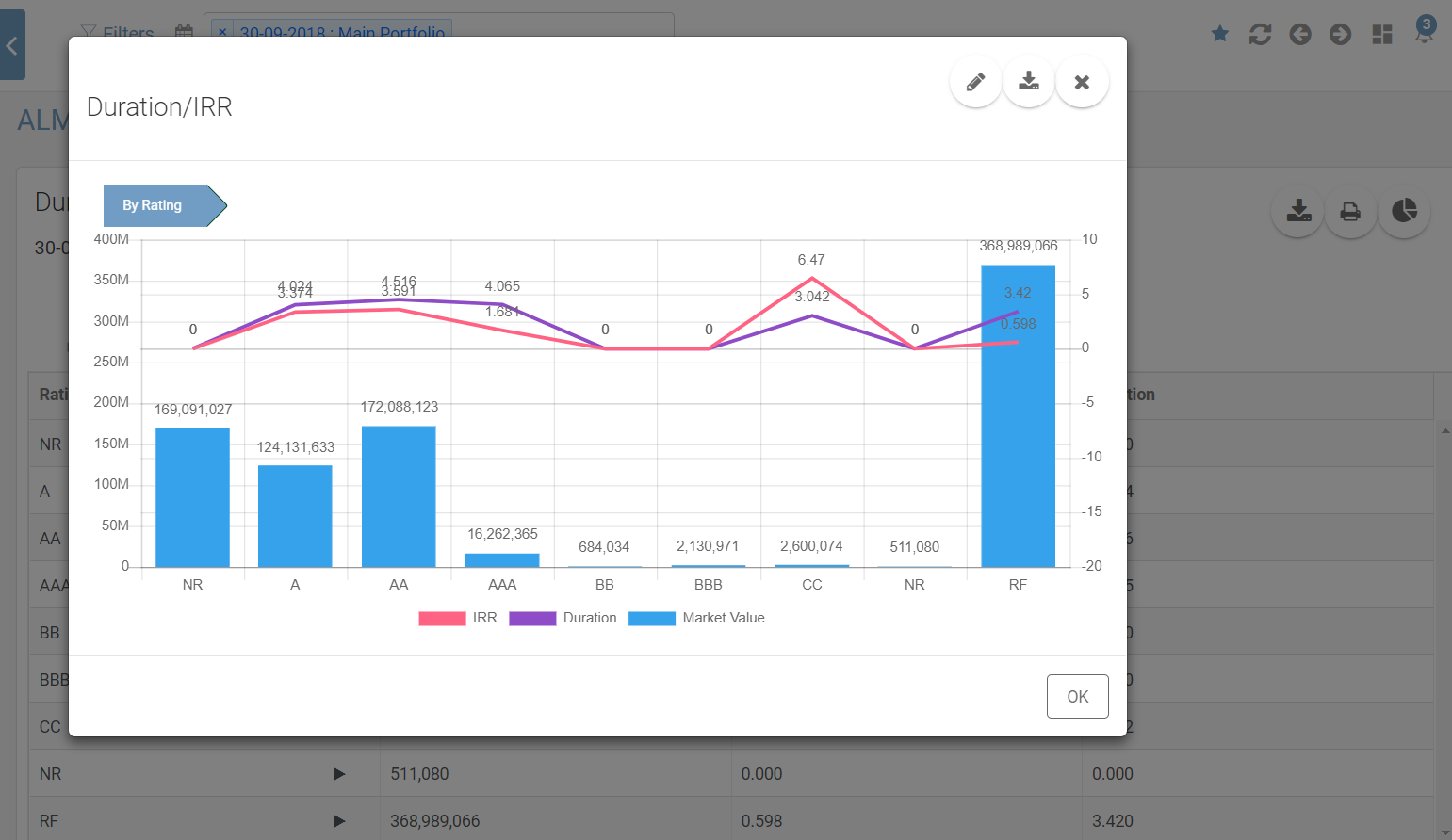

ALM reports

Edge’s detailed modeling capabilities provide you with all the critical components of ALM – balance sheet, fair value, duration/IRR, cash flows – to generate reliable ALM reports. With Edge, you manage your balance sheet effectively and satisfy regulatory requirements.

ESG

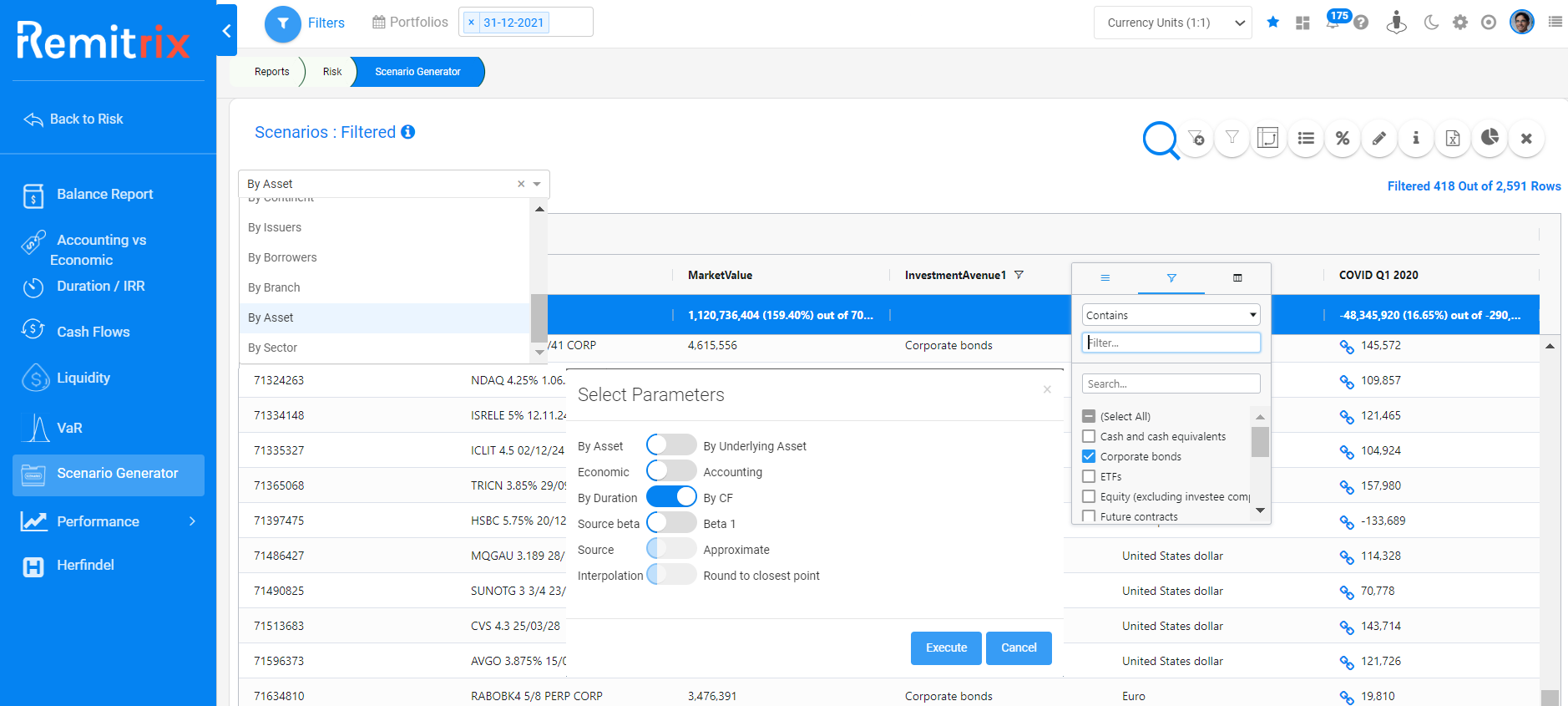

Models and reports are calibrated based on yield curves, spreads, currencies, stocks, and indices, as well as your evolving Monte Carlo stress scenario modeling needs, to help you to optimize your insurance strategy.

VaR Modeling

Historical and parametric VaR modeling in an efficient, consistent, automated, and auditable manner to save you many hours of time, and a lot of headache.

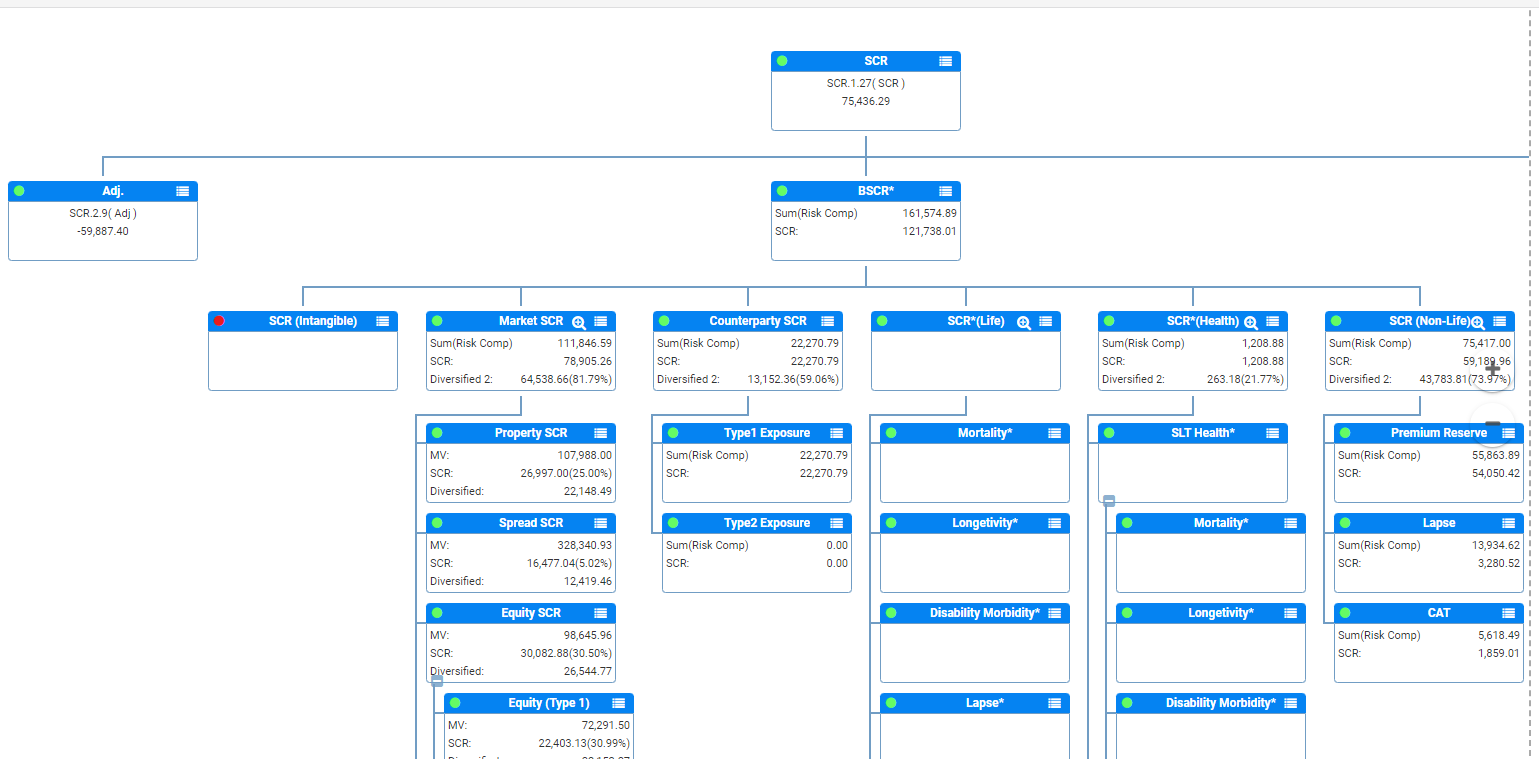

Edge+ Solvency II reporting and compliance

Enjoy a full and controlled calculation of Solvency II standard model that automatically determines assets solvency avenues and enables manual updating. Offers full control of Solvency parameters including yield curves and correlation matrices, as well as bottom up calculations of SCRs (Solvency Capital Requirement) for equity (separation of SA), spread, interest rates including liabilities effect, currency, property, and concentration. With Edge, you can apply financial scenarios to reevaluate impact on SCR. You can benefit from tools that assess the excess yield in relation to a capital requirement in respect of the addition of a single asset to the portfolio.

Reporting

All reports are downloadable to Excel.

Get Remitrix Edge with Remitrix Horizon to enjoy automatic reporting – QRT filing with main calculations file and helper tabs.

Intuitive dashboards

Customized dashboards make it easy to build risk reports. Filter data with multiple segments, drill down to the asset/policy level, and benefit from custom results. Slice and dice data just like in Excel. Visualize any report easily. Compare results through historical portfolios.

Online Support

The on-demand technical support is offered through an easy-to-use web-based ticketing system.

Dashboards

- Enhanced drill down graphical dashboard

- Create interactive live presentations to your audience

- Share your reports with your teammates

Drill down charts

- Chart query wizard quickly builds and visualize any report

- Drill down to asset level

- Compare through historical portfolios

Flexible and agile user experience

- Sort and filter your data just like in Excel

- Visualize any report easily and pin to your dashboard

- Filter data with multiple segments

- Data tables internal filter help you quickly find what youy are looking for

ALM reports

- Balance sheet

- Fair Value

- Duration/IRR

- Cash flows

ESG and VaR

- Economic Scenario Generator based on for yield curves, spreads, currencies, stocks, and indices

- Historical, parametric and Monte Carlo stress scenarios

- Value at Risk; Historical or parametric

Solvency

- Full and controlled calculation of Solvency II standard model

- Bottom-up calculations of SCRs (Solvency Capital Requirement) for Equity (separation of SA), Spread, Interest rates including liabilities effect, Currency, Property, and Concentration

- Automatically determines assets solvency avenues and enables manual updating

- Full control of Solvency parameters including yield curves and correlation matrices

- Apply financial scenarios to reevaluate the impact on SCR

- Tools for assessing the excess yield in relation to a capital requirement in respect of the addition of a single asset to the portfolio

- Automatic reporting is available under the full package (including Horizon) : QRT filing with main calculations file and Helper Tabs

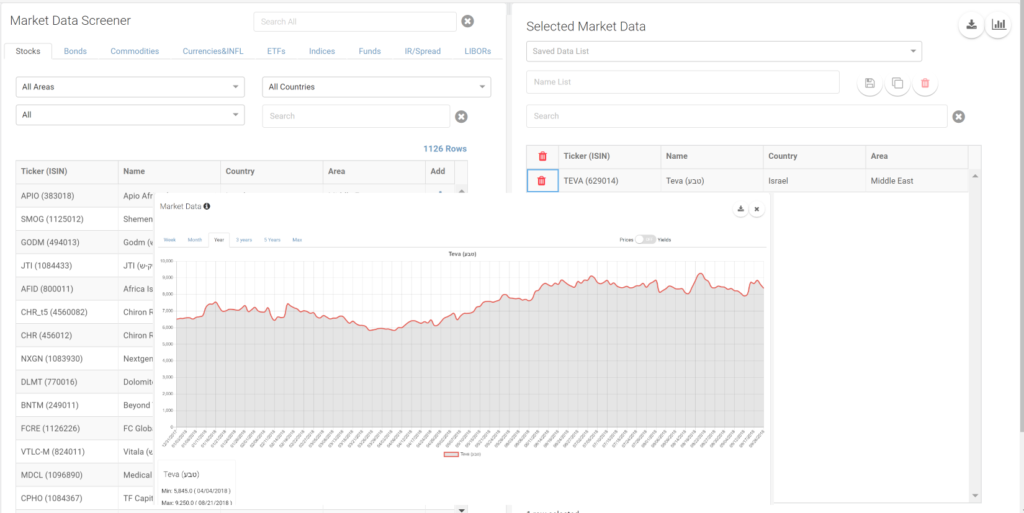

Market data

- Market data screener

- Visualizes market data through comparison graphs

- Download to Excel

- Historical data of over 15,000 risk factors: Stocks, bonds, commodities, currencies, ETFs, indices, funds, interest rates, and spreads

Live support

- Issue technical tickets to our support team

- On demand

- Web based support index